In March 2017 KPMG signed an unqualified audit report for Carillion plc for the 2016 financial year, just as they had previously for the years 2014 and 2015.

In July and September 2017, Carillion announced provisions of £1.045billion primarily arising from expected losses on several of its contracts and a goodwill impairment of £134m.

In January 2018, just ten months after the clean audit report was signed, Carillion went into compulsory liquidation with liabilities of almost £7billion and only £29m left in the till.

Until it went bankrupt, Carillion was a leading international construction, project finance and support services business operating in the UK, Canada, and Middle East. The collapse led to the loss of thousands of jobs and significant delays to major projects such as the building of hospitals. The collapse affected 75,000 people working in its supply chain.

Stating that “Our investigation concludes this was a textbook case study in failure,” the UK’s Financial Reporting Council imposed its highest ever penalty against KPMG, £30m with penalty fines of £500k and £100k against two former partners. These fines were all reduced by 30% for co-operation and admissions during the five-year investigation.

How did KPMG sink this low?

How did it happen that KPMG, the fourth largest auditing firm in the world, failed so catastrophically in its audit procedures? The full text of the Regulator’s announcement on 12 October 2023 - here– lays out chapter and verse of the failures.

That the audit fraternity (and KPMG in particular) has descended so low in the public’s opinion was summed up in a remark made during a Parliamentary enquiry, when one of its members told a former KPMG audit partner:

“I wouldn't hire you to do an audit of the contents of my fridge because when I read it, I wouldn’t actually know what is in my fridge or not.”

The Regulator’s report outlines all the audit deficiencies, of which the standout remark was:

"In particular, in 2016 KPMG … work in respect of Going Concern and Carillion’s financial position generally was seriously deficient. KPMG …. failed to respond to numerous indicators that Carillion’s core operation was loss making and that it was reliant on short term and unsustainable measures to support its cashflow."

- Preparing detailed forecasts will often be challenging, particularly in rapidly changing environments….

- important to review and update forecasts regularly until the financial statements are authorised for issue.

- forecasts (should be) … reasonable, supportable, and consistent

- The most severe but plausible downside scenario will need to be assessed when forecasting;

- Reverse stress testing ….might be useful to enhance the robustness of the going concern assessment.

But how are these forecasts prepared?

Almost certainly in Excel; and what does the ICAEW say about Excel?

In its release – Cashflow Modelling: Good spreadsheet practice, the ICAEW states, inter alia:

Such forecasts are often prepared in Excel – but spreadsheets are notoriously error-prone; and

A spreadsheet of any magnitude can be daunting to review, with perhaps thousands of formulas (sic).

Excel is not built to perform this task.

A comment in today’s Spectator relating to a parallel but unrelated inquiry, the UK’s current Covid 19 inquiry, is perhaps apposite:

'‘The vital question they need to ask is were flawed models better than nothing at all? As Nassim Nicholas Taleb said of flawed financial risk models:

"You’re worse off relying on misleading information than on not having any information at all.

If you give a pilot an altimeter that is sometimes defective, he will crash the plane. Give him nothing and he will look out the window.''

My suggestion: Software to product Going Concern Assessment forecasts should be robust and reliable.

What is needed to compile a robust and easily reviewable Going Concern forecast is a software package that:

Is not notoriously error-prone;

Does not have “thousands of formulae to review;”

Where the financial integrity of the forecast model can be quickly confirmed;

Employs a robust, double entry type architecture; in other words, it is self-balancing;

Produces a forecast cashflow, profit and loss, balance sheet and funds Flow statement;

Has separate fields for each line of costs, of revenues, of overheads, of assets, loans, equity etc., and computes payroll per employee using UK PAYE and NI rates and all relevant pension details;

Where separate projects can be individually modelled down to the gross profit and gp% value;

Is quick to produce and quick to update on a periodic basis;

Where stress testing and reverse stress testing can be conducted via a “what if” modelling capability; and

Can forecast individual companies or consolidate groups of companies, including where the group companies are using different currencies.

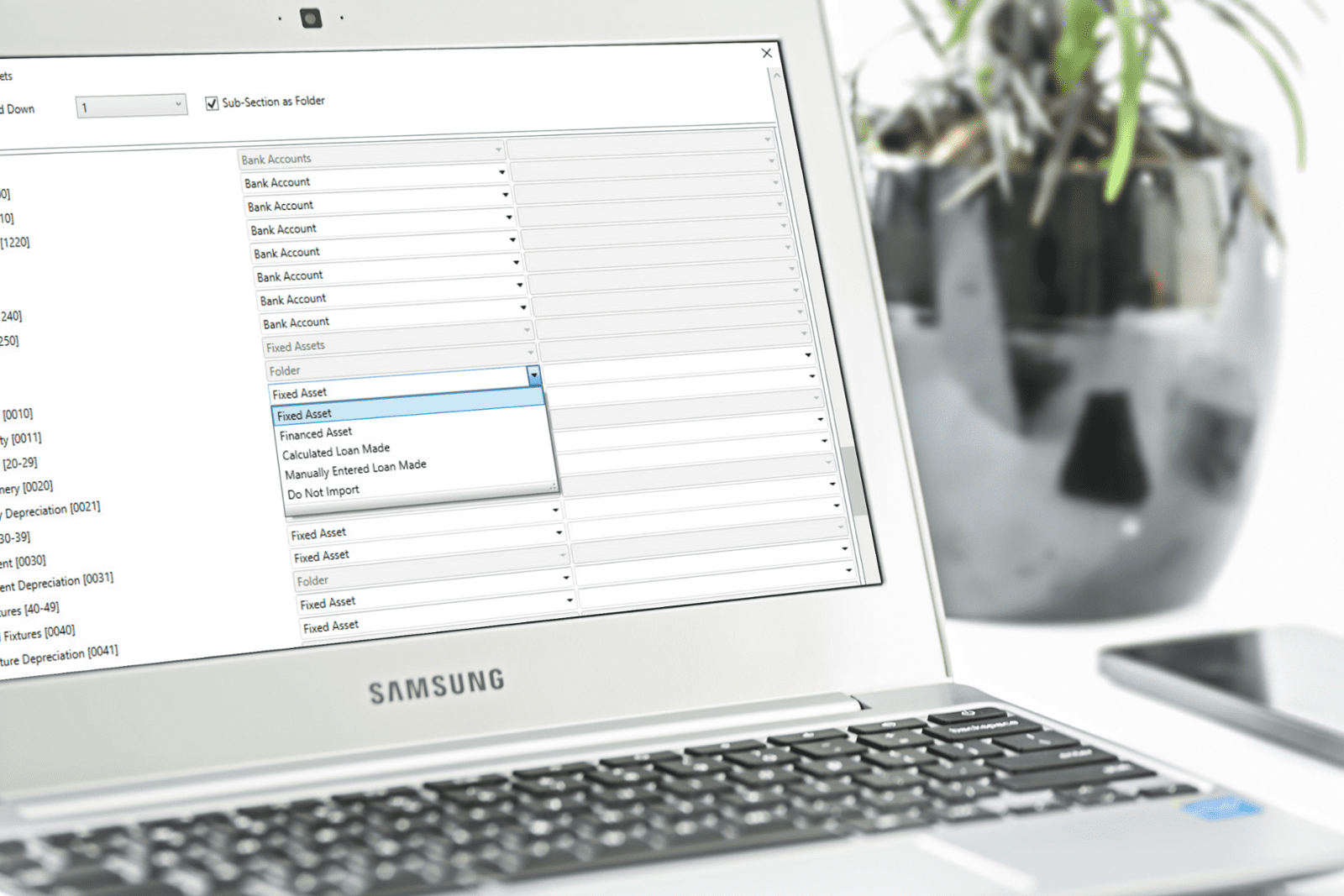

Forecast 5 meets these requirements!

We’d like to suggest the ICAEW and the FRC recommend companies use a reliable forecasting software package rather than Excel when preparing their Going Concern Assessments.

If you’d like to see how much easier it is to use Forecast 5 for your Going Concern Assessments, click on one of the links below

Related articles:

Quick, Responsive Forecasts and the Going Concern Assessment

Going Concern Assessments – use the right forecasting tools for the job!

Photo Credit: The Guardian